I would never leave the country without it. Travel insurance for solo travelers–or any travelers, for that matter–is essential and, like accommodation, meals, tips, etc., it should be considered a fundamental cost of any trip.

From Beijing, where I fell and ended up in a local hospital for an X-ray and acupuncture to Penzance, where I lost a pair of glasses hiking, travel insurance has come in handy.

If you don't buy it, you are financially and practically responsible for anything and everything that goes wrong as well as dealing with the fallout. If you do buy, you can claim many expenses back, as I have, for a variety of things.

- The glasses I lost were replaced: $300.

- I had a crown fixed that came off a tooth in Sydney: $272.

- I was refunded for a flight to Peru that I couldn’t take due to my mother’s ill health: $1,100.

- The Bottom Line First: Recommended Travel Insurance Brokers

- Your Guide to Travel Insurance for Solo Travelers: 12 Questions Answered

- What's the most important kind of insurance to buy?

- Is travel insurance expensive?

- Is it ever a good idea not to buy travel insurance?

- Could credit card or airline travel insurance be enough?

- Should I buy annual or single trip insurance?

- What's the best time to buy travel insurance?

- Do I need a travel insurance specialist?

- What's the right insurance for medical coverage for my trip?

- Note

- Does my pre-existing condition make medical travel insurance too expensive?

- Do I really have to read the fine print on insurance policies?

- Video: Experts Answer Our Questions about Solo Travel Insurance

- Always Have an Escape Plan

The Bottom Line First: Recommended Travel Insurance Brokers

The consensus is that travel insurance can be worth every penny. Yes, there will be times that you buy it and don't use it. In fact, you hope that is the case. But if something happens that you need it and it's there, well that makes up for all those other times. Here are my recommendations.

- If you're American, I recommend TravelInsurance.com. They are an insurance broker that represents many companies. Buying online with them is easy and there is also a number to call if you have questions.

- If you're Canadian, I suggest Medi-Quote. They are a specialist travel insurance broker as well. I talk to a live person when I'm buying from them but you can get an anonymous quote here if you're curious.

Your Guide to Travel Insurance for Solo Travelers: 12 Questions Answered

What's the most important kind of insurance to buy?

Accidents happen. It is when we are out of our normal routines that accidents tend to happen more often. I was told this by an emergency room doctor and this bit of information has stuck. As we travel, we are definitely out of our normal routines. Ordinary health issues can arise just as easily when you're traveling as at home.

The most important types of travel insurance to buy are emergency medical and emergency evacuation.

- Emergency medical treatment can run from a day's budget for food to an annual salary and beyond. There is no way that I would ever risk financial ruin to save $30 (for a younger person on a small trip) to a few hundred dollars. I suggest that travelers always have emergency medical coverage.

- Emergency evacuation is the second necessity in the travel insurance category. It is for getting you home to your own medical and personal support network when necessary.

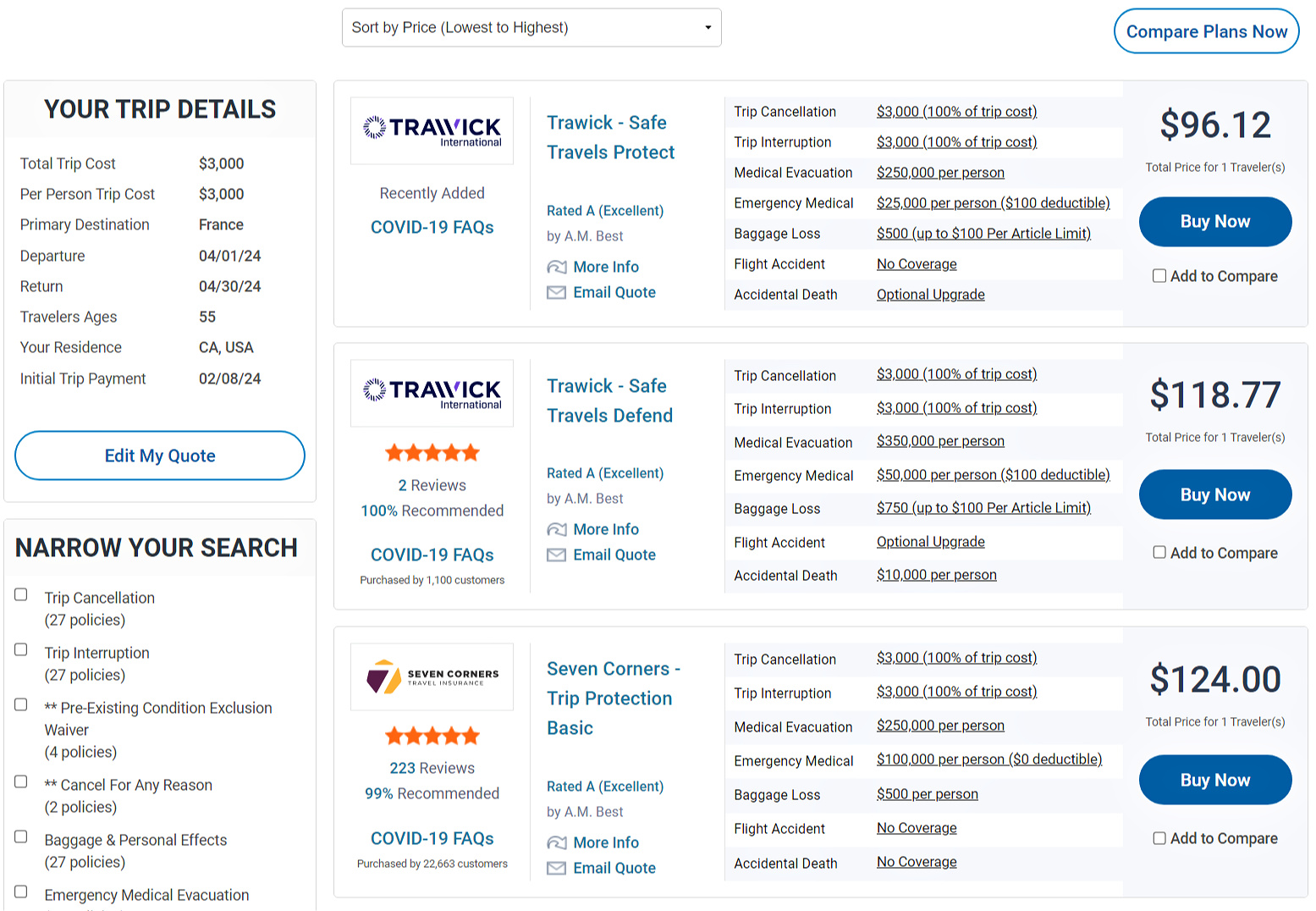

Below is an image of a quote from TravelInsurance.com. It shows full coverage for a $3,000, one-month trip to France for a 55-year-old traveler starting at less than US$100. For that price, I don't know why anyone would choose not to buy travel insurance.

Is travel insurance expensive?

As you can see from the price comparison above, travel insurance does not have to be expensive. You also have options. While medical travel insurance is necessary, I consider the additional coverage below as optional. It depends on the value of your trip and your willingness to endure inconvenience and financial loss. Read on to determine whether these options are important for you.

- Companion coverage. Should you be in hospital for a period of time, your insurance company will send a friend or family member to be with you, covering their costs and their insurance. This is a crucial component of travel insurance for solo travelers specifically. It's often included in a standard policy.

- Trip cancellation, interruption, or delay. This is particularly important if you have purchased a tour or cruise, in which case you should buy insurance as soon as you make a deposit on a trip. When you travel independently, you don't usually put out as much money up front, making this coverage somewhat less critical.

- Trip cancellation for medical reasons. Should your trip cancellation be due to health issues, you will likely be covered by the medical portion of your travel insurance.

- Trip cancellation due to border closings, tour cancellation, or severe weather. This is where you want to read the trip cancellation portion of your travel insurance. Have a look at the details of your policy to see what is deemed coverable.

- Trip cancellation due to a health emergency in the family. A few years ago, everything for my trip was planned, but my mother fell ill. As a primary caregiver, my travel insurance refunded the expenses I had incurred for the trip.

- Trip interruption. The terms for trip interruption are similar to those for trip cancellation.

- Trip delay. This is typically for when your trip is delayed for a day or two.

- Baggage and personal effects loss, theft, or damage. It can be a huge inconvenience if your baggage is lost. If everything goes missing by your airline or you lose an item while on your trip, this is the insurance feature that will kick in. If you have a lot of expensive gear such as computer, photography, or sporting equipment, it may be worth taking photos of everything before leaving so that you have proof of ownership. Baggage delay coverage will typically kick in once your baggage has been delayed for a specific number of hours. To help avoid the inconvenience, read Luggage Trackers Review: How to Find Lost or Stolen Bags.

- Cancel for any reason. This is typically an add-on to regular insurance and is not offered by all insurers. It is a very expensive option and less common in the wake of the COVID-19 pandemic.

Is it ever a good idea not to buy travel insurance?

While I believe in travel insurance, I don't believe in taking insurance every time it's offered (see Insurance Upsell: How to Know When to Say No). I always recommend emergency medical coverage. Depending on your risk tolerance, you can self-insure for the coverage of protection as explained above.

Could credit card or airline travel insurance be enough?

Before buying travel insurance it's best to determine whether you're already covered by your company health plan or your credit card while you're traveling. To do the analysis, look for the gaps between what you consider to be adequate coverage and what you actually have. This requires reading the small print.

Look at the financial limits of the coverage and whether you're covered in the countries you're visiting for the length of time you'll be traveling. All these factors can affect whether you have adequate insurance. Check for the following:

- emergency medical coverage limits and deductibles

- terms around pre-existing medical conditions (read more about this below)

- companion coverage, which is especially important for solo travelers

- upfront payment for claims. Do you have to pay for services and get reimbursed later?

- trip delay coverage

- trip length limits

- age restrictions

- baggage loss coverage

- baggage delay coverage

If you feel you want a bit more coverage, you can purchase “top-up” insurance.

Should I buy annual or single trip insurance?

When buying travel insurance you first need to consider your travel plans for the year.

If you're only planning one or two trips of a couple of weeks, you will likely be better off with a single trip plan for each. Once you're up to three trips or trips of longer duration, you will want to compare price and coverage with annual plans. Annual plans have a maximum length for each trip. Check what the maximum number of days are for the plan you're buying. You can buy top-up insurance for trips that are longer.

What's the best time to buy travel insurance?

Travelers are becoming more savvy when it comes to pre-trip cancellation benefits.

- When should you buy single trip insurance? If you're going to buy a full travel insurance plan that includes trip cancellation, buy the insurance as soon as you put out money for the trip. This will protect your investment from the start.

- When should you buy annual insurance plans? If you are purchasing a new annual plan based on a specific trip, the advice above applies. If you are renewing an annual plan, I would delay the renewal until you put down money on your next trip. There's no need to pay insurance for months when you're not traveling.

- When is age a factor? If you will be turning a significant age, such as 65, you may want to purchase your insurance before your birthday as the rate could be lower for a year.

The option of purchasing insurance after departure is becoming more common, however, there are usually waiting periods for it to come into effect and, if there is a disaster declaration, it won't apply.

Do I need a travel insurance specialist?

My best advice is to use a travel insurance broker. Not all general insurance brokers have travel insurance expertise. You want to know that the broker is licensed and that they are specially trained in travel insurance.

You can also buy travel insurance from travel agents, but they are only allowed to sell it, they are not allowed to give advice. Basically, you're buying it off the shelf with no consideration of your particular circumstances. Since it's a complicated purchase, I recommend a broker specialist.

Here are my recommended travel insurance brokers:

- TravelInsurance.com in the United States

- Medi-Quote in Canada

There are lots of details to consider when it comes to travel insurance for solo travelers, especially medical coverage. The language of policy documents is not always easy to understand. If you have questions, pick up the phone and get them answered clearly by either the insuring company or a licensed travel insurance broker.

What's the right insurance for medical coverage for my trip?

My primary goal with a travel insurance policy is to be protected from medical emergencies. To lose $2,000 on a flight is one thing. To lose tens of thousands on medical costs is quite another. When buying travel insurance, it's important to understand what is covered, the limits of the coverage, and deductibles.

Most travel insurance policies should cover expenses for medical attention, paramedical services, ambulance, emergency dental, and expenses to return home or bring family to your bedside. When shopping for coverage, compare the dollar limits available for similar benefits and any deductibles. For example, two policies may both offer emergency medical coverage but one may offer $5,000 in coverage while another provides $5,000,000. I don't think that anything under $250,000 is adequate. The more coverage the better.

Two special considerations:

- High-risk Activities Some companies won't insure for activities like scuba diving or mountain climbing. Some won't even cover snorkeling or zip-lining. If you are an active traveler, make sure that the things you're inclined to do are covered.

- Emergency Medical Reunion This is a particularly important part of travel insurance for solo travelers. Emergency medical reunion is offered by many policies, however, the terms can vary greatly. Again, know the exact terms of the insurance you're considering so that you can make a proper comparison between companies.

Does my pre-existing condition make medical travel insurance too expensive?

Before purchasing travel insurance, solo travelers should consider their pre-existing medical conditions and the risks associated with treatment for those conditions while away.

Having a pre-existing condition does not mean that you will not be covered and it does not necessarily mean that the cost of insurance will be ridiculous.

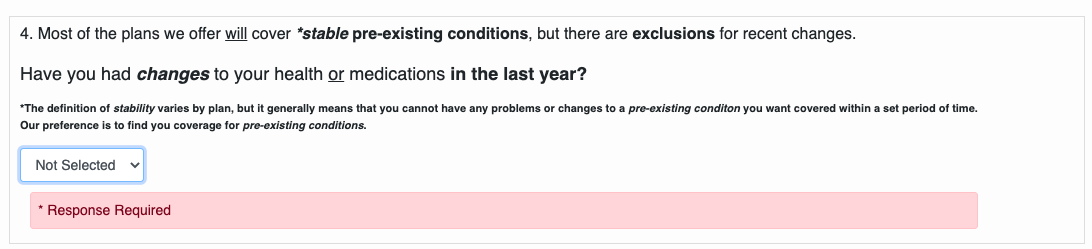

Some insurance policies may offer full coverage for existing conditions while other policies may require that your health has been stable for a period of time. This is called a stability clause and it's used to limit what the insurance covers. Still others are more concerned about pre-existing conditions as they relate to trip cancellation insurance rather than medical insurance.

In some cases, you can purchase travel insurance without completing a medical questionnaire. While this may sound great, it can mean that you are not covered for certain pre-existing medical conditions. In addition, in a few price comparison studies, I have found that policies that have medical questionnaires are less expensive than those that don't.

If you have pre-existing conditions, it is important to:

- read the fine print concerning pre-existing conditions carefully before you buy. Pay special attention to the policy’s definition of “stable” and “treatment”. These definitions can vary and directly impact your available medical coverage.

- be completely honest about any pre-existing conditions when signing up for insurance so that your policy will not be considered void for misrepresentation.

- call the insurance company so that you're really clear on what their terms mean. For example, if you have a heart condition you may still be covered for a heart attack as this is an unpredictable event. Seriously, make the call. Their customer support people can be very helpful.

Do I really have to read the fine print on insurance policies?

Yes. It's wise to do so. Once it even saved me money as I learned that the glasses I lost on a hike were covered. But that was reading after the fact.

Read the fine print before you buy and know the exact terms of the insurance you're considering so that you can make a proper comparison between companies. Download the Certificate of Insurance. This is usually available in smaller print on any page promoting a plan or at the bottom of the site under the heading, “Forms”.

Video: Experts Answer Our Questions about Solo Travel Insurance

Always Have an Escape Plan

I was in Morocco when the pandemic was declared in 2020. Marco, our trip leader shown above, was working hard to ensure that everyone on the trip got home safely. But it was Marco I was concerned about. He was going home to Italy where the pandemic hit hard. I just happened to walk by a display that had this t-shirt for sale. How appropriate. And good advice for us all.

For more on the value of travel insurance as well as the importance of prevention, read How to Prevent or Deal with Getting Sick Traveling Solo. And to ensure you stay safe on your journeys, see Solo Travel Safety: 50+ Proven Tips.